Zatca-Int

The Zatca-Int (Zakat, Tax, and Customs Authority) Tool is a solution designed to help businesses comply with Saudi Arabia’s tax regulations. Many organizations face challenges with manual data entry, which is time-consuming and error-prone, especially when preparing invoices for submission to the government portal. Extracting, formatting, and posting invoice data often requires technical expertise, leading to inefficiencies and increased costs.

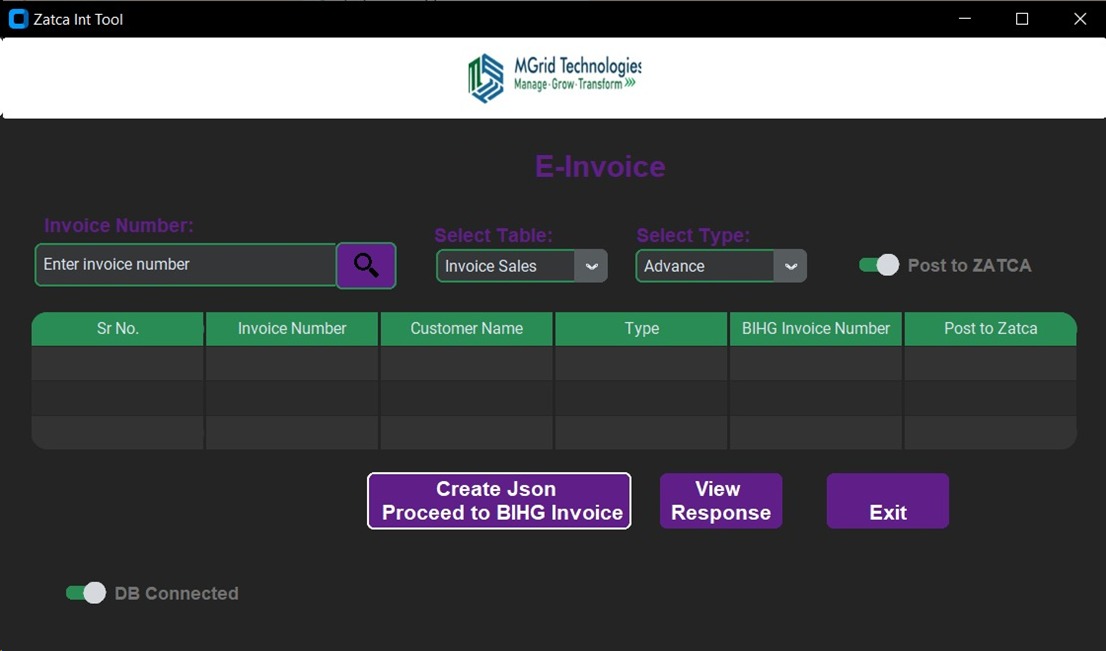

The Zatca-Int Tool simplifies this by automating invoice submission, ensuring compliance, and reducing errors. It helps businesses save time, optimize resources, and focus on core operations. With a user-friendly interface, automated checks, and secure data handling, the tool ensures accuracy and efficiency, streamlining tax reporting and making it faster and hassle-free.

Additionally, the Zatca-Int Tool integrates seamlessly with existing accounting and ERP systems, eliminating the need for manual data transfers. It supports multiple data formats, enabling businesses to generate and submit invoices effortlessly while adhering to regulatory requirements. By automating the validation process, the tool ensures that invoices meet ZATCA’s e-invoicing standards, reducing the risk of rejections and penalties.

Beyond compliance, the tool enhances financial transparency by providing real-time tracking and reporting features. Businesses can monitor invoice statuses, generate detailed tax reports, and gain valuable insights into their financial operations. These analytics help organizations identify trends, detect discrepancies, and make informed financial decisions, ultimately improving overall tax management.